History really does repeat itself – after all, we live on an enclosed social/political/ecosystem without a pipeline to another planet. That results in a finite number of things we can do and the resulting outcomes.

For example, Mikhail Gorbachev was running out of money with a teetering economy and he needed to be better friends with Ronald Reagan and in 1991 the USSR ceased to exist and the former republics had to stand on their own and it was tough: No free money from Moscow. Well, Vladimir Putin has two driving factors: He craves power personally and for Russia striving to recreate the USSR – he’s said so: “The demise of the Soviet Union was the greatest geopolitical catastrophe of the century.” Then, add that he has a petro economy rivaling the most powerful OPEC members and you have the Ukraine conflict.

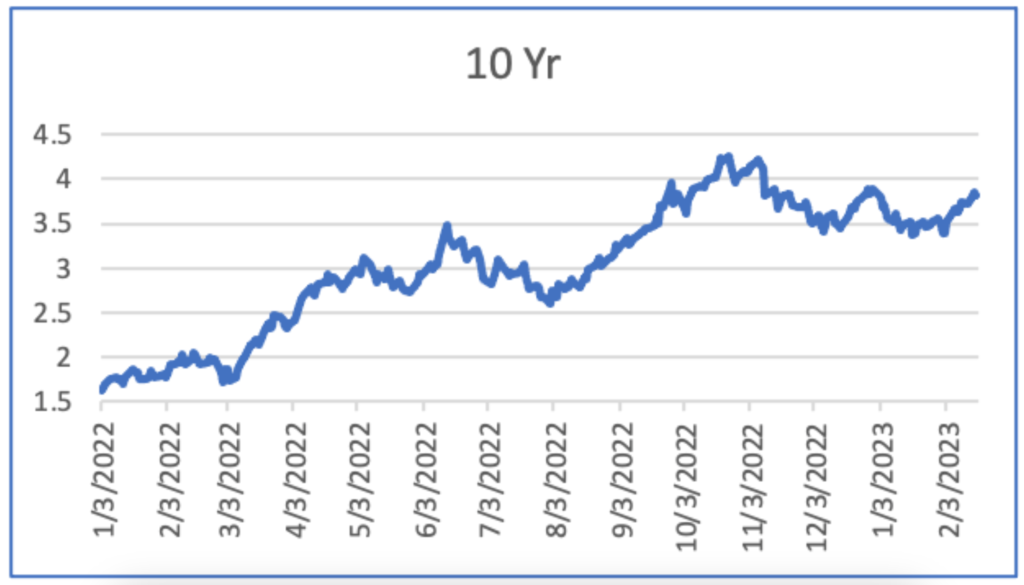

Now I admit these blogs aren’t supposed to be political and I’m hardly qualified to opine on these heady issues but I am focused on your economy and mine and oil is the most powerful economic fulcrum of modern time and the war and the Russian oil business are having an outsized influence on our lives today. In that same 1991 Russia pumped 470 mega tonnes of oil and in 2021 that number was 523 mega tonnes and today they’re having a hard time selling that same oil. November of ’22 a barrel was $84.43 vs. June of ’22 it was $108.29 and that volatility and uncertainty of supply influence you and me in complex ways. Inflation – the buzzword of the day – has shown just how volatile the markets are:

…just look at the 10 Year Treasury Bill over the same period:

My point is this is a cycle that we’ve seen repeat in the past and, pending no unforeseen massive events such as World War III, we will live to see again.

I am reading Ray Dalio’s “ Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail” and find a central theme, the changing of the world reserve currency from the US Dollar to the Chinese RMB, to be a view into the future of these trends. Today’s pithy bit of advice, with the well advised grain of salt, is to heed a quote from that book: “No system of government, no economic system, no currency, and no empire lasts forever, yet almost everyone is surprised and ruined when they fail.” and find the resulting good advice to be from that same book in that for our nation and our communities and our businesses to focus on “strong education and competitiveness”.

These data are solely the opinion of Saulsbury Hill Financial, LLC and do not reflect the opinions, guidance or recommendations of any other entity or person(s).