Welcome to 2022!

We hope there’s a great 2022 ahead for you, your family, friends and business. These will be interesting times to navigate and my crystal ball is as clear as anyone else. Every business and opportunity is unique, each community has its’ own circumstances and each technical solution is focused on an individual problem. One area of focus is the cost of capital for your projects translated to interest rates.

We began 2021 with the 10-Year US Treasury Bill at 0.93% and closed New Years Eve at 1.52% – an increase of over a half percent rising over 63% in rate and guess what, as I write this on January 7th, it’s at 1.76% and still climbing at 0.24% the first week of the year. At this pace it will make Paul Volcker look like a penny pincher!

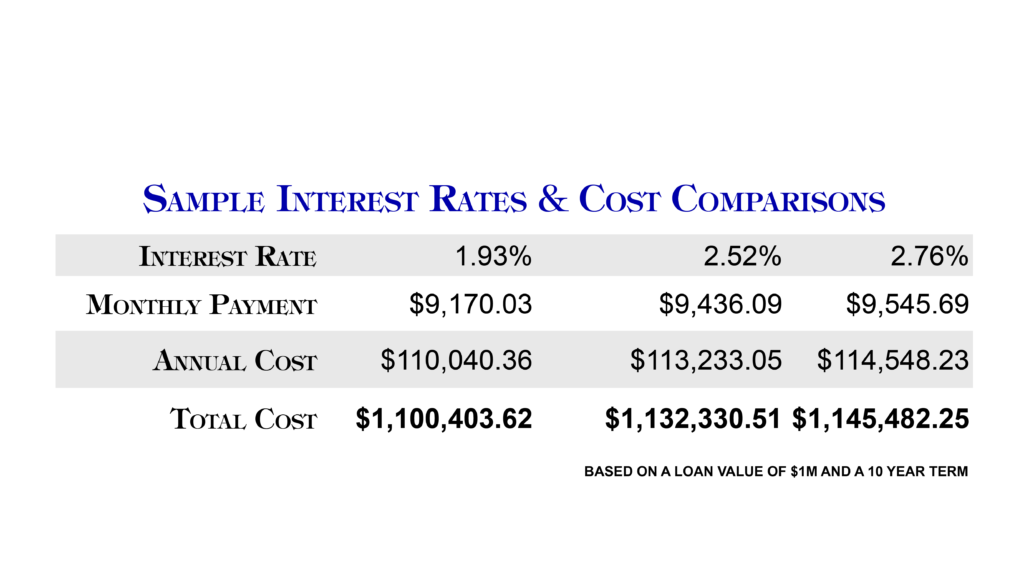

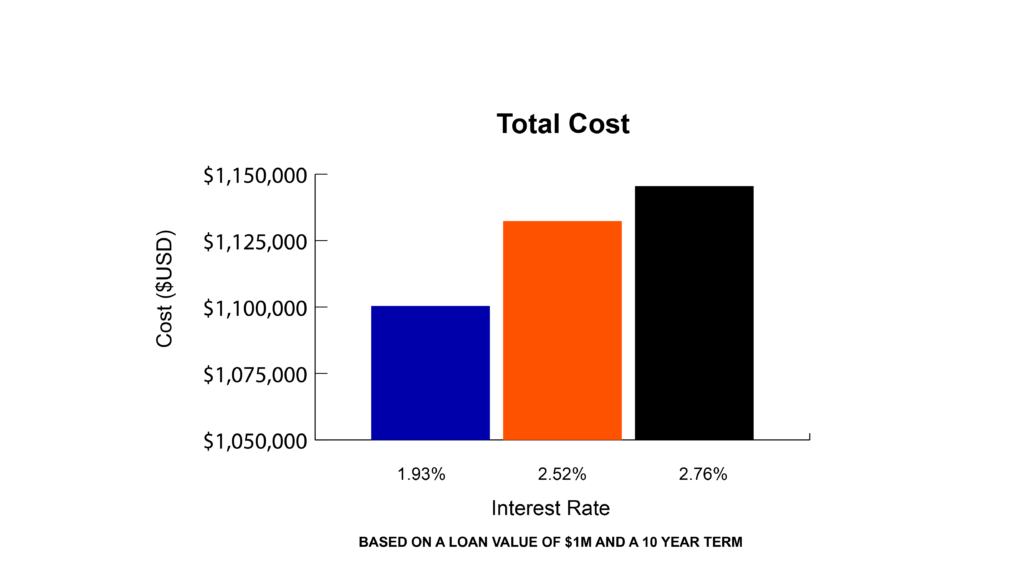

What does this mean for you and your projects? The short answer is act now. If you borrowed $1M the first business day of 2021 for 10 years at that 0.93% T-Bill rate plus 1% or 1.93% and did the same transaction on New Years Eve at 2.52%, and just last week at 2.76%, you can see the difference in your budget below:

And the inverse of your costs going up, the costs of the status quo and postponing your project also go up in lost savings, improved productivity and increased uncertainty.

As previously stated, my crystal ball is pretty cloudy for the months ahead. If Shakespeare was right, “Past is prologue” and being prepared is the best tool.

Comment below or email our team today to tell us what topics you’d like to see us discuss in the coming months!

David J. Clamage

Managing Director, Saulsbury Hill Financial

davidc@saulhill.com

These data are solely the opinion of Saulsbury Hill Financial, LLC and do not reflect the opinions, guidance or recommendations of any other entity or person(s).