The “pink paper” – The Financial Times – recently took up the question of inflation and in doing so, Stefan Legge, PhD at the University of St Gallen dug up a lovely quote from no less than Adam Smith in an auspicious 1776:

“When national debts have once been accumulated to a certain degree, there is scarce, I believe, a single instance of their having been fairly and completely paid…the raising of the denomination of the coin has been the most usual expedient by which a real public bankruptcy has been disguised under the appearance of a pretended payment”.

This goes to the most basic of definition of inflation best quoted by John Maynard Keynes, “Inflation is the result of excess aggregate demand over the aggregate supply and the true inflation starts after full employment.”

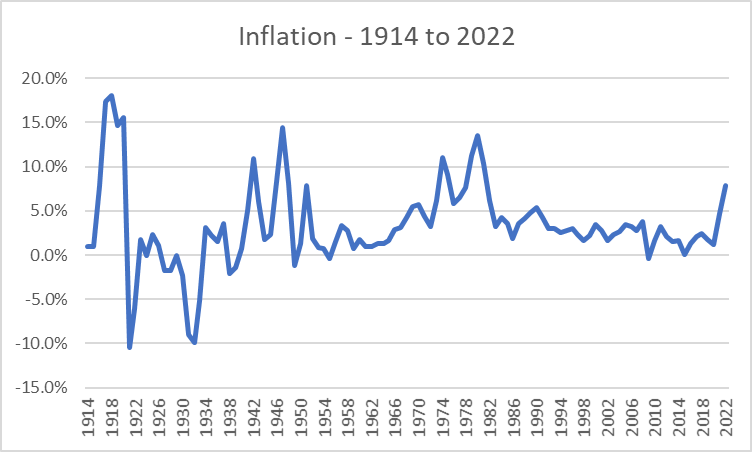

Why drag out these long-in-the-tooth economists? We’ve been here before! We are indebted right past our eyebrows and have printed so much money, now seeking a home in the form of demand. It’s like planting corn and expecting eggs. $431 Billion for TARP in ’08, $831 Billion in 2009 for ARRA, $2.2 Trillion for CARES alone and I could go on – you get the point and the point is inflation.

I have no advice – only facts. Tamping down debt with a higher cost of capital will slow growth and, in turn, slow inflation. Chairman Powell and Chairman Volcker reacted accordingly as did Chairman Strauss in 1918 with inflation at 18% and so did Chairman Mills in 1932 when inflation was an astounding negative 9.9%. Opportunity exists in both extremes and in between.

Brutus told Cassius: We must take the current when it serves, or lose our ventures.

These data are solely the opinion of Saulsbury Hill Financial, LLC and do not reflect the opinions, guidance or recommendations of any other entity or person(s).