It’s hard to write these blogs sometimes – there so little good news except for my Denver Nuggets winning the Oscar Robertson Trophy for the first time in Denver Nuggets history! Maybe that’s a good sign for the future ‘cuz with politicians vs. business women and men running our economy, we’re not getting any free throws.

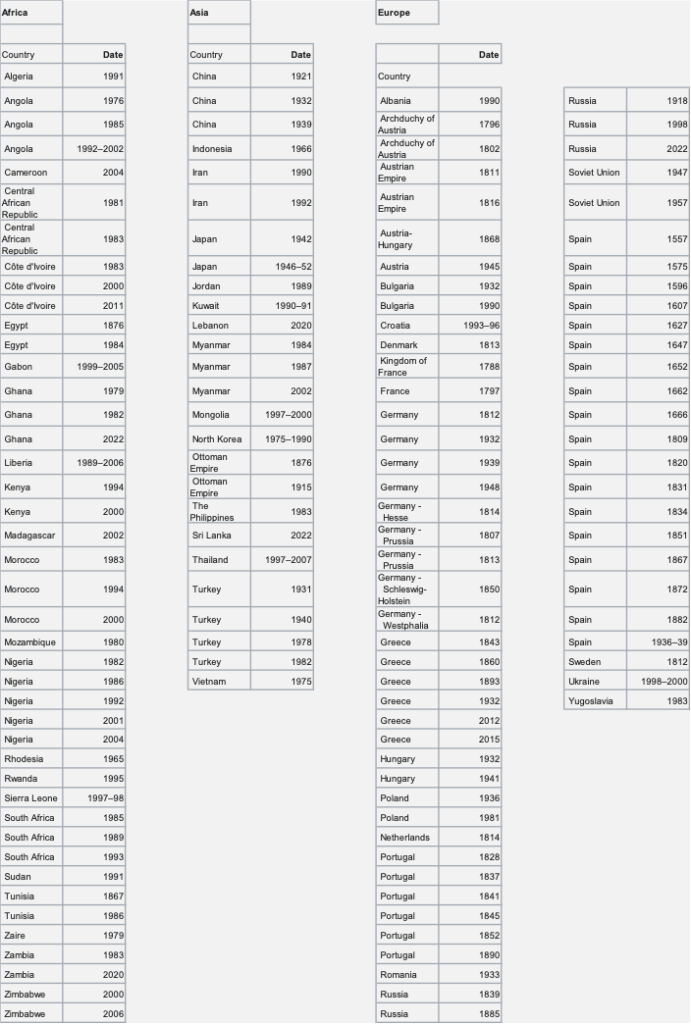

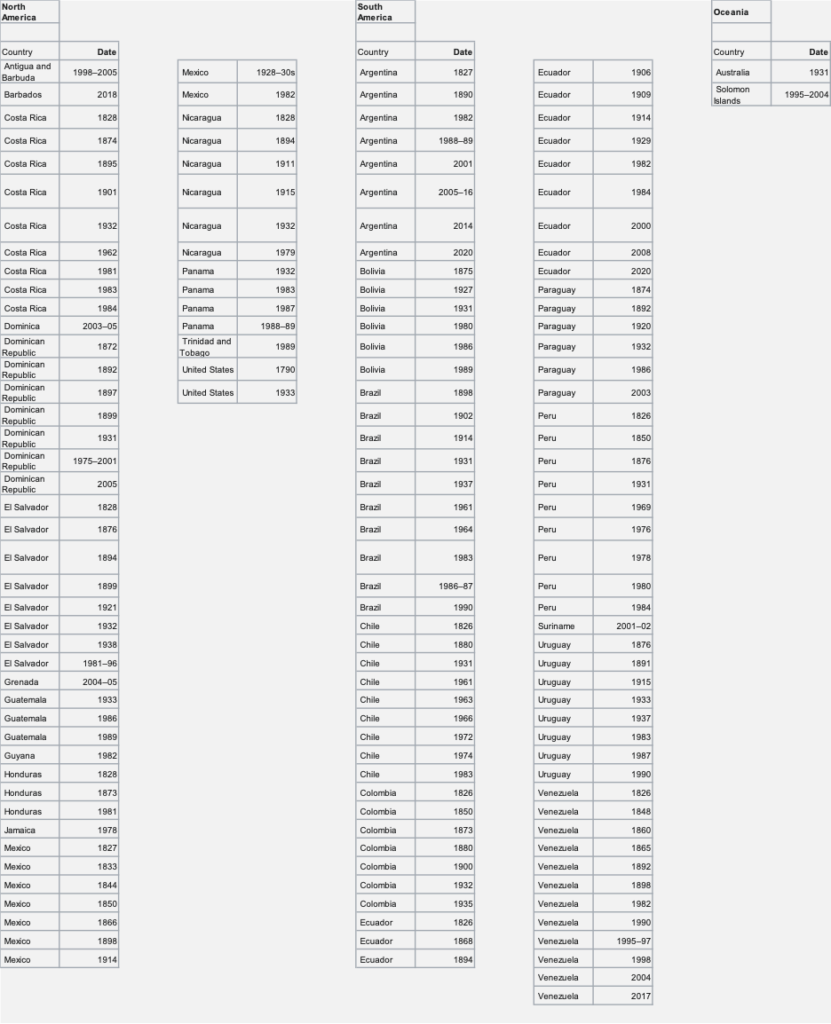

History is a great teacher and having a quick look at the default of other sovereign debt may be time well spent, though you may be reading this “if and when” the problem with US debt is solved one way or the other. First off, the list is long and with no shortage of repeat offenders. I count no fewer than 200 instances of default including the US in 1790 and the suspension of payments, (I think your mortgage company would call that a default), in 1933. Spain is the likely winner with 18 visits to the beggars banquet with even Germany racking up 9 times and Greece a half dozen. What’s common – in each instance where there was a globally traded bond market for these borrowers, in the years after their failure to pay, they paid measurably more for new debt when they could get it; their economies were severely and adversely impacted for extended periods of time; and, their populations suffered.

Sadly, this is one of those blogs where I do not have an umbrella for you – this is a rainstorm well outside the ability of anyone to forecast. Will it be a drizzle or a deluge and will we have green expanse nurtured by the new found discipline of fiscal prudence or will the landscape be ravaged by floods? My friends, your guess is as good as mine and I cannot tell you if a flight to cash or gold is a good idea or if buying ¥ or £ or € is our answer.

What I do know is what Frank Zappa told us: “Never discuss politics in a disco”.