John Maynard Keynes gave us the definition of inflation for the modern era adding a few causes and cures. One cure is printing enough money to create growth and jobs to promote economic growth.

Well, we have printed money! In 2020 alone we poured some $5 Trillion into the economy or enough money to lay $100 bills end to end to the moon and back over 10 times!

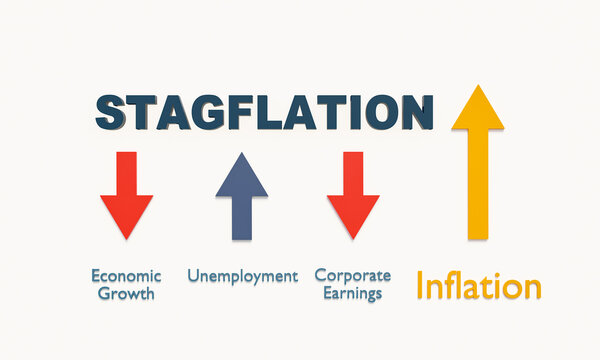

Now folks are suggesting stagflation is in the forecast. What is stagflation and why is that a likely outcome for the near term? Stagflation is when the economy has both an increase in inflation and slowing growth. Inflation we can see at the grocery store and gas pump and pronouncements from the Federal Reserve but slowing growth is harder to see. Single family housing starts are down – slightly, but down; total car sales tanked in 2020 by some 16% and are poised to be down another 24%; real GDP was down 1.4% in the first quarter; and, I could go on – you get it.

What does this mean for you, your business and your community? Well, like all economists I can point at least a half dozen directions at once so this is my best guess: Your dollars, in real spending power, will decline as a result of inflation and there is likely to be a resulting recession with more slow growth as result of the fed raising interest rates so again, more slow growth. One solution becomes efficiency – using those dollars, people power and time to do the work you do more efficiently by buying equipment and services to assist that pursuit while also increasing productivity: Doing more with less and at the same time using the dollars you carefully spend to fuel the economic growth of the people from whom you buy those goods and services.

Sometimes the simple answers are the best.

These data are solely the opinion of Saulsbury Hill Financial, LLC and do not reflect the opinions, guidance or recommendations of any other entity or person(s).