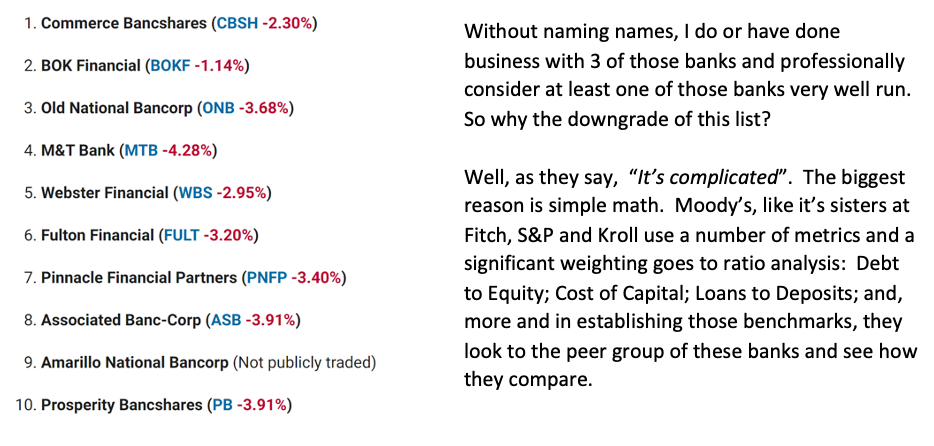

For those of you who remember, Bailey Savings & Loan might have gotten a lousy credit rating in today’s world causing a run on the bank due to Uncle Billy misplacing $8,000. On August 7th, Moody’s downgraded[i] the following banks and you can see what happened to their stock:

Now in and of itself, that’s not a bad yardstick but it can miss the mark: We’re in a period of time when the capital markets writ large are in disarray; the pundits say that commercial real estate values are down some 11% with a forecast decline of as much as 40% by brand name sources; and, what about that soft landing of our economy we’ve been hoping for? Yup, it’s tough to measure the depth of the lake with so many waves.

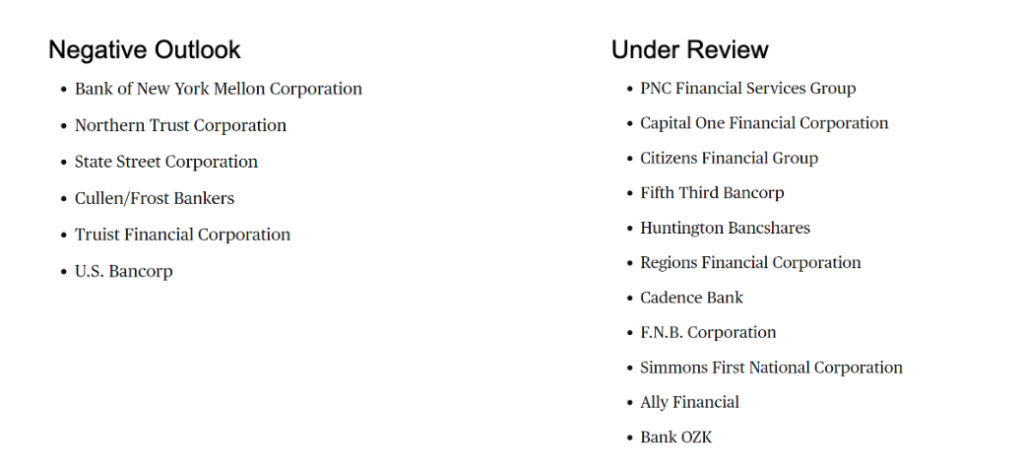

And then we have even more banks in Moody’s cross-hairs and of these 17 banks I know from experience 6 of ‘em and of that 6, I firmly believe that at least 2 are very very strong and well run institutions. But hey, it’s called Moody’s Corporation not Clamage Corporation.

I will close with a couple of friendly tips and the first is “diversify” – if you have money or loans concentrated at one bank and your operations would be severely adversely impacted by a disruption in that bank’s ability to do business, you need to find a couple of additional banks to share your deposits, loans and relationships. Why, well banking is all about trust and if your banker trusts you so much, why do they chain down the pens?

[i] We do not own stock in any of these institutions nor are we expressing any opinion – good, bad or indifferent – on the merits or demerits of the actions of Moody’s.