According to our friends at the National Oceanographic and Atmospheric Administration, a seven-day forecast can accurately predict the weather about 80 percent of the time and a five-day forecast approximately 90 percent of the time. However, a 10-day—or longer—forecast is only right about half the time. EA Sports boasts a 50% accuracy for the NFL and there are machine learning – yup, AI – tools that got the NBA right 74% last season. And moving into our wallets, the Bureau of Labor Statistics at the 90% level of confidence meaning there’s a 90% chance an estimate based on the sample will differ by no more than 1.645 standard errors from the population value. Dang – that’s pretty good!

So why then can’t the FED forecast where inflation will be tomorrow, next week or next year and deliver to us the preferred soft landing…what we pilots call a greaser.

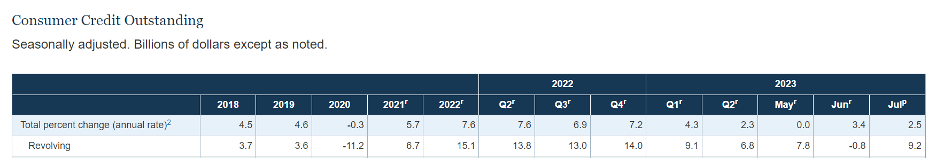

It’s simple really: We are to blame – the US consumer. We hold the keys to the American Economic Engine and we’re darned unpredictable. This year alone we’ve gone from an increase in borrowing on our credit cards from a high in Q1 of 7.6% to a low of 2.5% in July and if you asked your neighbors about their spending habits on the good old MasterCard, would they agree they used it 5.1% less in July than January?

Yup, it’s our spending that tells the tale and sources like the CONFERENCE BOARD tell us retail sales jumped in July as US consumers continued to open their wallets. Consumer spending was up 0.7 percent month-over-month (MoM), above the expectation of 0.4 percent. Adjusted for inflation, sales were up 0.6 percent from May and we used our credit cards less so the data is confusing to say the least. That soft landing becomes increasingly elusive as the navigation gets tougher. So pour yourself a up of tea and read “The Beige Book”[i] – one cup should get you thru 32 pages – and remember, there are 12 Fed Districts and the St. Louis Fed’s Beige Book team sends out an email survey to several hundred contacts at a variety of businesses and nonprofits across the Eighth District so you can see there will be lots of opinions, data, facts and fiction.

So while the FED is not really flipping a coin or consulting your favorite weather person, it’s tough to see the future.

[i] https://www.federalreserve.gov/monetarypolicy/files/BeigeBook_20230906.pdf