This will be my 4th post on the very convoluted topic of interest rates. There are so many factors that can and do influence their movement – from Jay Powell and the US Federal Reserve to the Right Honorable Jeremy Hunt, MP, as Britain’s Chancellor of the Exchequer to the market giants like Goldman Sachs and their ilk right down to you and me and our bond and money market accounts. The combination of art and science in forecasting their movement is just that: Art and Science.

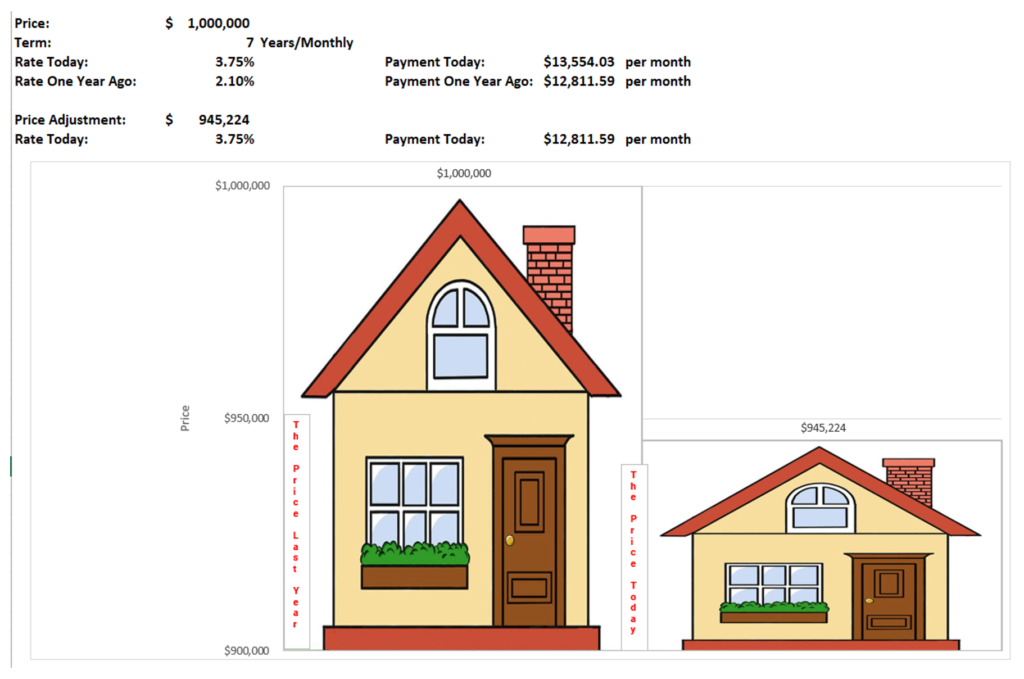

In the depth of the Great Depression, the Federal Reserve lowered rates and began buying bonds to help stem the loss of funds from the banking system and improve liquidity. And, what then seemed like a big number – on Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13%, looks quaint vs. the over 22% drop in 1987. And when you see a 15.82% 10 year treasury in September of 1981 during Messrs. Reagan and Volcker, it makes today’s 3.51% feel like a bargain! So we look for the correlations – where the changes in rates can off set changes in what we use credit for – our businesses, our communities and our homes. The ratio between price and the cost of capital is just that – a ratio:

Since I spend a fair bit of time financing state and local governments – muni-land – these rates are indicative of where we were last year and where we are today. Holding last years payments, your dollar now buys a $945 thousand house vs. a $1 Million one. Or, by putting 5.5% cash down you are both lowering your payment to last year’s dollars and, essentially, paying yourself today’s interest rate on that 5.5% in cash you invested. Like I said – a ratio.

Now this ratio is sure to change as rates continue to rise, inflation makes that asset more expensive, and the supply chain makes it more scarce and the key to managing that ratio for you and your stakeholders is adding the utility of that asset to your evaluation: The cost of doing “something vs. nothing”.

Thanks again for reading and we really do appreciate your ideas for future blogs so keep ‘em coming in and in the meantime, have a great holiday season!

These data are solely the opinion of Saulsbury Hill Financial, LLC and do not reflect the opinions, guidance or recommendations of any other entity or person(s).