Interest rates continue to be in the top news items: Russia – Ukraine; North Korea; Climate Change; Politics; and, Inflation. Being an economist by education, I can even find a way to relate all of these factors to the cost of money and that would be more opinion than fact. Remember, if you line up 3 economists, they will point 4 different directions so I’ll stick to my thread for the day about the crystal ball in interest rates and that begins with that funny term: The Inverted Yield Curve.

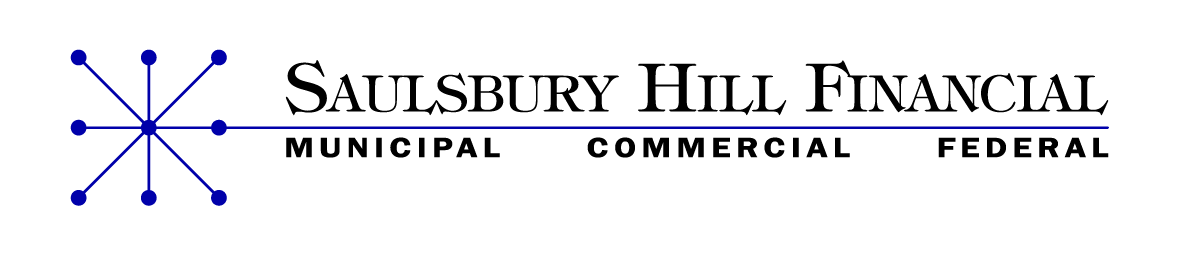

It would seem logical to most of us that if you borrow money for 10 years vs. 2 years, you should have to pay more for the money and 5 years ago on 11-15-17, that was true when looking at US Treasuries.

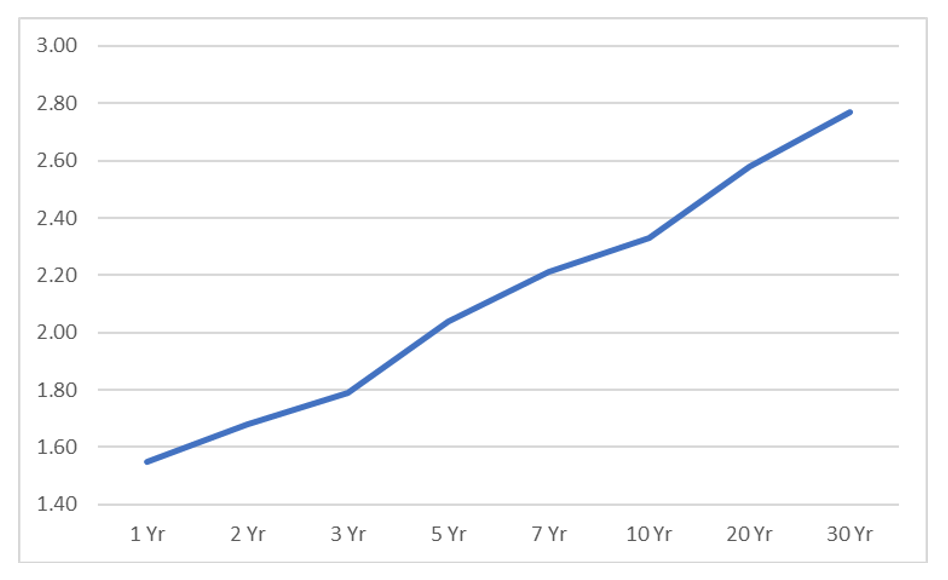

But today, there is nothing logical about the economy or interest rates. The curve on 11-15-22 is profoundly inverted with short term rates actually higher than long term making it very hard for folks to plan ahead. Well, you can plan ahead for a recession.

This is a classic example of an inverted curve and what that tells us is the rain is coming! And friends, this is a pretty accurate forecast of a recession. Why, because investors buying those treasury bonds think that long term rates will actually decline. This is not an idle comment –this inverted curve has been accurate for the last 10 recessions.

So, while I am not a doomsayer, I do carry an umbrella with me and so should you. Whether we get a soft landing on our financial runway or a real lousy arrival to the global economic airport, you can’t get hurt by being prepared. Locking in your cost of financing today is always smart – you know what you’re dealing with vs. planning in the blind.

What do I really think? I live in Colorado and it’s November so that means it’s gonna snow!

These data are solely the opinion of Saulsbury Hill Financial, LLC and do not reflect the opinions, guidance or recommendations of any other entity or person(s).